In the event of a claim, email your Client Executive as soon as possible. Please include EQUA's claims department at claims@equaspecialty.com.

What Information Should I Gather?

When reporting your claim to EQUA, please include the following details:

- Company Name

- Contact Name and Phone Number

- Policy Number (if available)

- Date of Loss

- Loss Details (a brief description of what happened)

What Happens Next?

- We will acknowledge receipt of your notification

- An EQUA Claims Representative will be assigned to your file and will be in contact with you as soon as possible to explain the process

- We will ensure your Insurers have been notified and that the necessary steps are being taken to protect your interests

- We will be with you every step of the way to facilitate a well communicated, fair, and timely resolution of your claim

With EQUA, you can expect transparency, real-time status of a claim, empathy and care from our team, and an efficient process that is built to support a timely resolution.

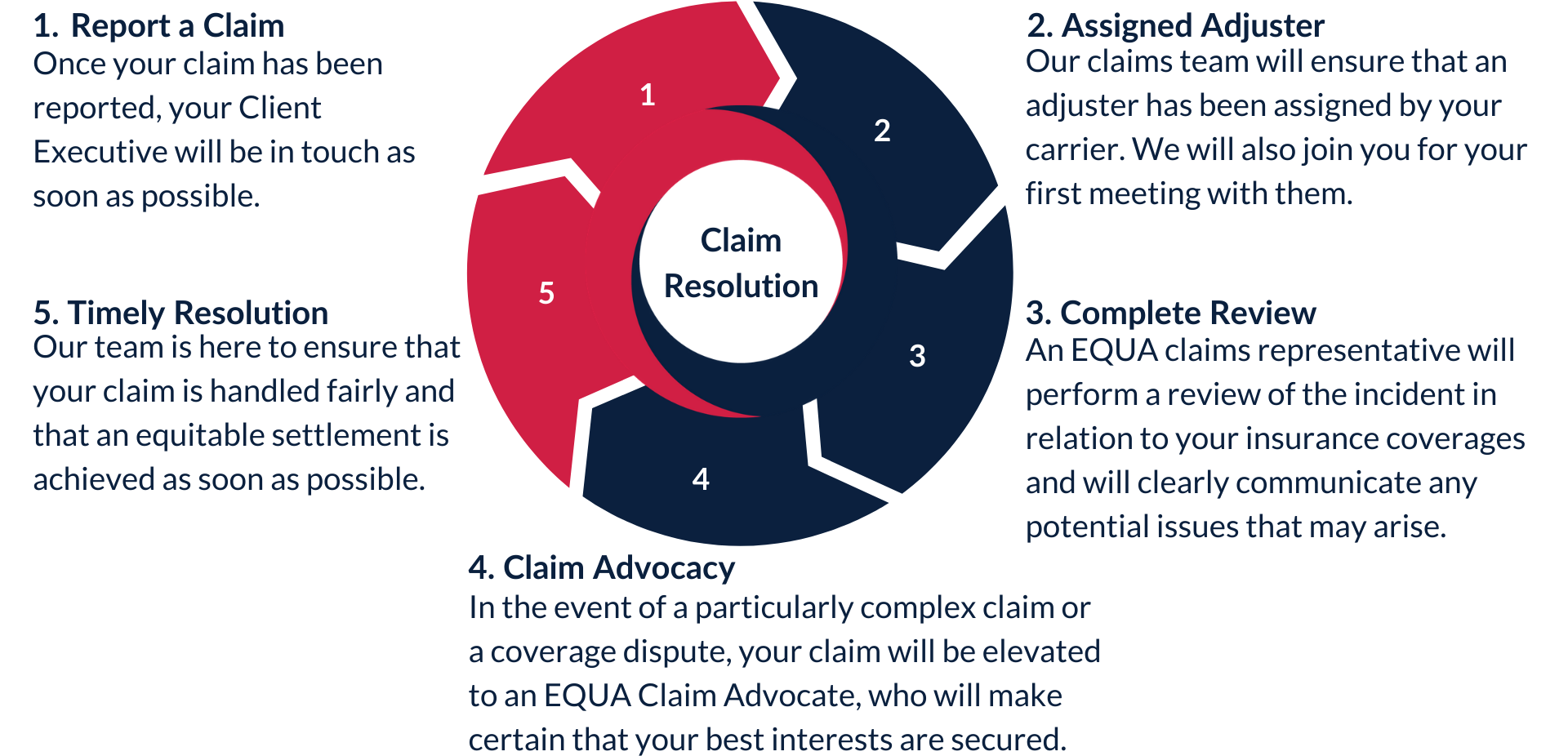

The Complete EQUA Claim Process

We recognize that the role of the insurance broker is so much more than collecting information, obtaining estimates, and binding coverage. Never is this more apparent than when a claim arises. We know from experience that the main causes for client frustration during the claim process are:

- Speed of settlement

- Explanation & transparency of the claim process

- The ability to establish the real-time status of a claim

- Frequency & timeliness of communication

- Empathy & care of staff

Our experts have the experience and know-how to handle even the most complex claims. We have designed the EQUA Claim Process to ensure that client concerns are fully addressed and that a well communicated, fair, and timely resolution of claims is at the heart of what we do.

While proper claims handling helps mitigate losses, a comprehensive risk management plan helps prevent them from happening in the first place. Our experts are ready to create an innovative risk management program for your unique business needs.